Blog > What Homebuyers Need To Know About Credit Scores

Some Highlights

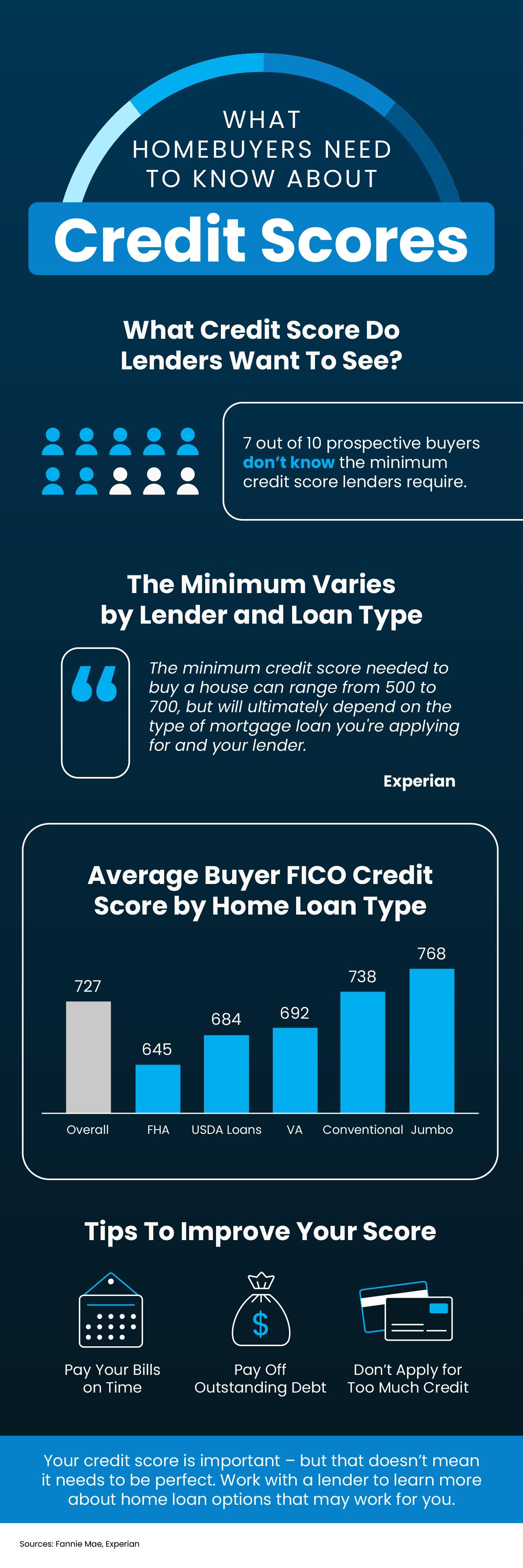

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.